Student loan debt is a burden for many Americans. The Federal Reserve Bank of New York estimates the nation’s outstanding student loan debt to be between $902 billion and $1 trillion.

It can be easy for those paying back hefty loans to turn to a third-party company, offering to cut what you owe. The NOW looked into some of those companies to investigate if it’s worth it.

September Adams has her plate full, with raising her son and helping to care for her grandson. On top of it, Adams works full-time. She says she was feeling overwhelmed, and then a phone call, offering help, came.

"They actually called out of the blue saying they were doing some debt consolidation and that this was a great choice,” says Adams. “And it was going to help me in the future."

Adams admits the call from the company promising to consolidate her student loans sounded too good.

“I was so excited at the time, thinking that, you know, we were going to consolidate everything and everything is going to be one payment,” says Adams. “But, it turned out not what I thought it was."

The company charged her $1,300; Not to pay off her loans, but to help enroll her in a program to consolidate loans she already had. They also put her on a federal program to lower her monthly payments. She didn't have the $1,300, so the company financed that amount and charged her another monthly payment at 20 percent interest.

Adams didn't realize there was the fee and admits she should have read the paperwork more closely.

"It's all available for free,” says financial aid expert Thad Spaulding, with Metro State University of Denver.

Spaulding says you can actually enroll in the program without even spending a cent.

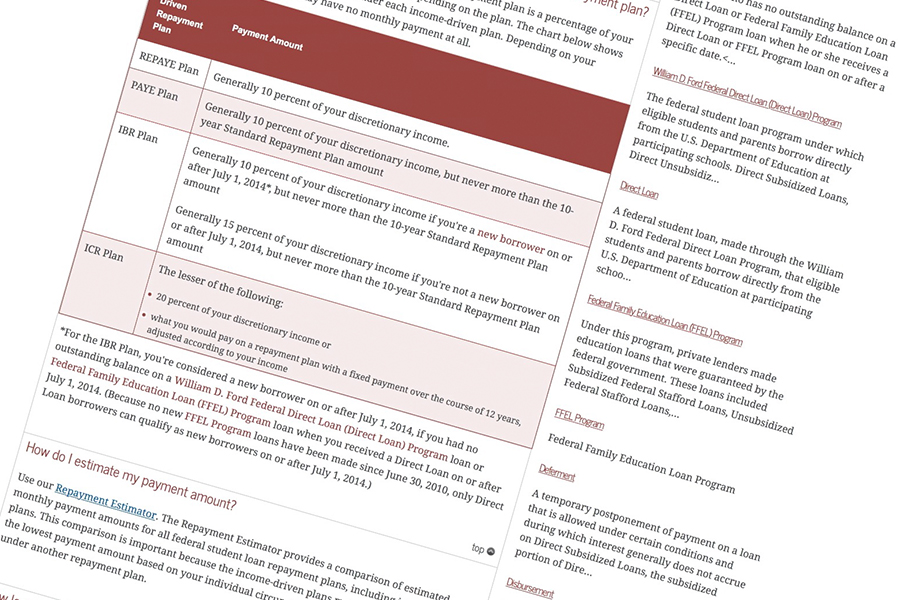

In fact, as The NOW was investigating, we found the government website for student aid studentaid.ed.gov walks you through the whole process. It says people can do it in as little as 10 minutes.

Spaulding says your school or lender can help you for free, too.

"It's pretty simple and very straightforward," Spaulding says.

Companies who offer to help you consolidate your loans for a fee have a different take. They will often say the process can be hard to manage. One company points out that sometimes people just don't know about the helpful programs that are out there and are willing to pay someone to walk them through the entire process.

Adams wishes she had known she could have done it herself and avoided the $1,300 loan, an extra loan she has to pay off.

"This is on my credit as a credit card. It's like a credit card."